Content on this page may include affiliate links. If you click and sign up/place a wager, we may receive compensation at no cost to you.

How Much Tax Revenue Do Online Casinos Really Generate?

Licensed online casinos produce millions of dollars in tax revenue on an annual basis in US states that have regulated them.

U.S. states that have legalized and regulated real money online casinos annually collect millions of dollars in tax revenue. The amount collected and percentage of their annual budgets that iGaming tax revenues cover vary based on the state's population, market competitiveness, and online gaming tax rate.

The Raw iGaming Tax Revenue Numbers in the Three Biggest Online Casino States

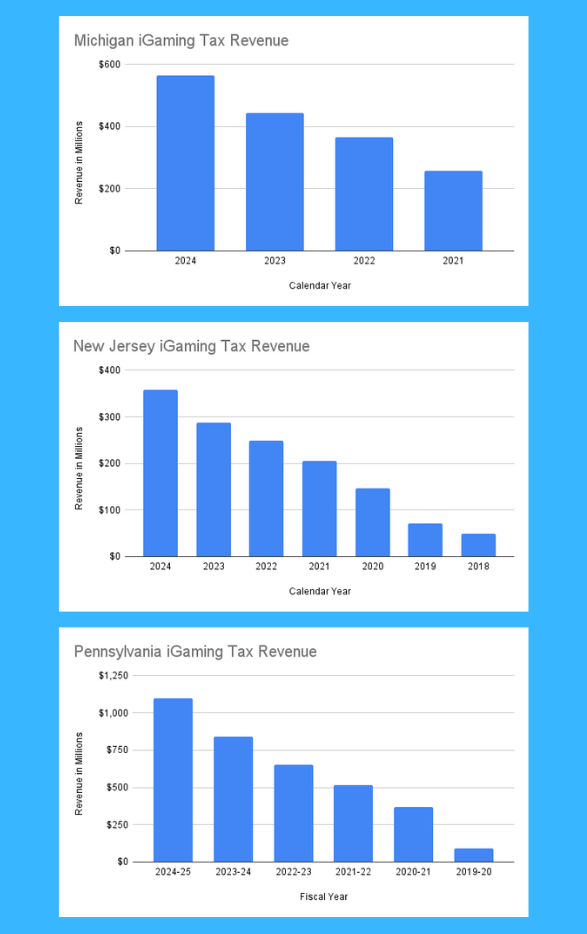

Michigan, New Jersey, and Pennsylvania are the three most populous states that have created a regulated system for online casino games. In all three, tax revenue from iGaming has consistently grown annually.

For example, legal Michigan online casinos launched in January 2021. Each calendar year through 2024 has seen tax revenue increase by at least 21%.

Michigan, New Jersey, and Pennsylvania all maintain regulated systems that allow for multiple online casino brands. That isn't universally the case, however.

The Delaware Lottery has contracted with Rush Street Interactive to make its BetRivers Casino brand the only legal option in the state, as one example. Comparing Delaware's online casino tax revenue to that of Michigan, New Jersey, or Pennsylvania, however, will be skewed because Delaware's population is significantly smaller than that of any of those three states.

The competitive nature of the markets in Michigan, Pennsylvania, and West Virginia also makes a big difference because operators spend much more on online casino bonuses in those states, which can result in more frequent play. The tax rate is another crucial differentiator between these states.

How Tax Rate Affects iGaming Revenue for States

New Jersey's and Pennsylvania's regulated systems for online casinos are similar in many ways. New Jersey's estimated population represents about 73% of Pennsylvania's.

The main reason for the discrepancy between the tax revenue that New Jersey and Pennsylvania collect is the rate at which Pennsylvania taxes iGaming win for the licensed operators. While brands like BetMGM online Casino in New Jersey pay a 15% tax, Pennsylvania levies a 54% tax on online slot win and a 16% rate on win for licensees like Caesars Palace Online Casino.

That is the main reason why Pennsylvania has cleared the billion-dollar threshold in terms of tax revenue from iGaming. While these numbers look impressive, proper context is essential to understand their value to states.

How Online Casino Tax Revenues Contribute to States' Budgets

Important context for iGaming taxes in these three states begins with the size of the states' budgets.

- Michigan: $81 billion for the fiscal year 2024-25

- New Jersey: $58.8 billion for the fiscal year 2024-25

- Pennsylvania: $47.6 billion for fiscal year 2024-25

Another crucial piece of context is that not all of the tax revenue from play on apps like FanDuel Casino in these states goes directly to the state treasury. In all of these states, the state government shares the tax revenue with city and/or county governments.

Pennsylvania tops the legal iGaming states in terms of the percentage of its annual budget funding that comes from online casino play. However, New Jersey has elevated its tax rate for iGaming revenue to 19.75%, signaling an emerging trend of states looking to gaming revenue for additional money.

While iGaming states collect millions of dollars annually from the gaming, it represents a small portion of the states' budgetary needs. There has been steady growth in the segment, but as costs also rise, states may continue to assess their tax structures for iGaming.